Amazon’s made big changes to inventory management in 2026, and not in a good way. Between tighter storage limits, new inventory-related fees, and a bigger focus on your IPI score, poor inventory planning can cost you thousands. It’s not just about stocking the right products anymore. It’s about staying efficient with space, fees, and restocks all at once.

In this guide, I’ll walk you through the most important updates, metrics, and strategies to keep your FBA business lean and profitable. With over a decade of experience selling on Amazon, I’ve seen how quickly inventory issues can spiral, and how much smoother things run when you’ve got a clear plan in place. We’ll cover everything from IPI scores and capacity limits to forecasting, fees, and the most common mistakes I see new sellers make.

Why Amazon FBA Inventory Management is so Important in 2026

Inventory management has always been an important part of selling on Amazon, but in 2026, it’s become a daily battle against higher Amazon fees and tighter storage limits.

In its simplest form, inventory management means keeping the right amount of stock available when and where it’s needed. That means sending inventory in before you run low, planning for upcoming sales, and avoiding any long-term storage fees or overstocking.

This year, getting that balance right matters more than ever. One stockout can drop your product from page one to page three overnight. I’ve seen it happen. And once your listing starts to suffer, it usually takes a lot of advertising dollars and a burst of sales to recover your rank. Overstocking isn’t any better. Amazon has raised long-term storage fees and now penalizes excess inventory that isn’t moving.

The window for error keeps shrinking. Capacity limits are tighter. Inbound space is limited. And both understocking and overstocking now come with extra fees.

Here are a few of the recent changes making inventory management more important than ever:

- Faster rank drops after stockouts: Since March 2025, listings can fall from page one to page three within 24 hours of going out of stock. Getting back takes a lot of ad spend and sales velocity.

- Low Inventory Fee: As of April 2024, if you consistently hold less than 28 days of stock, Amazon hits you with a new fee for understocking.

- Tighter FBA Capacity Limits: In May 2025, Amazon announced it was reducing FBA capacity from 6 months of forecasted sales to 5. This makes it more difficult to forecast inventory for high-sales periods like Prime Day or Q4.

So, how do you stay on Amazon’s good side while keeping your business lean and in stock? It starts with understanding how your inventory management is being graded. That’s where your IPI score comes in.

Understanding and Improving Your IPI Score

Before we talk IPI scores, you need to understand how Amazon views your inventory. It’s not just what’s available for sale. They track every stage from units in transit, inventory reserved for customer orders or fulfillment center transfers, unfulfillable stock, and stranded units that are sitting in a warehouse but disconnected from a live listing. All of it counts toward your performance, even if your product technically shows “in stock” on the surface.

Amazon uses the Inventory Performance Index (IPI) to score how well you manage all that. Think of it as your inventory report card, updated weekly. The score ranges from 0 to 1,000. If you stay between 450 and 550, you’re in a healthy range. Climb above 550, and you may unlock more storage and lower fees. But if your score drops below 400, Amazon can reduce your storage limits, reject inbound shipments, and start tacking on extra surcharges.

To calculate your IPI, Amazon uses four key metrics: FBA In-Stock Rate, Excess Inventory Percentage, FBA Sell-Through Rate, and Stranded Inventory Percentage. Let’s break down each one and discuss how they work.

FBA In-Stock Rate

This metric tracks how often your best-selling FBA SKUs are actually available to buy. Amazon puts the most weight on products with a strong sales history, so stockouts on those items hurt your score more than less popular items. If your top sellers are frequently unavailable, Amazon sees your business as unreliable, which hurts you’re score.

To maintain a strong in-stock rate, I recommend keeping at least 60 days of inventory on hand for your core SKUs. Don’t rely on FBA limits to guide your reorders; try to use actual sales data instead. If a shipment’s running late, try to slow sales by temporarily raising your prices or pausing your ad campaigns. It might sound counterintuitive, but it’s better than running out completely.

Excess Inventory Percentage

This measures how much of your FBA inventory is considered overstocked. Amazon flags anything with more than 90 days of supply, or even just a single unit aged over 90 days. The higher this percentage, the more your IPI score suffers.

To bring this number down, your first step should be to discount the product, either directly or through coupons and deals. If that doesn’t work, try bundling the product or running a PPC campaign. And if it’s still not selling, you may need to pull it entirely. I’ve had to do this myself. In one case, I created a removal order and just stored the boxes in my garage for a few months to avoid long-term storage fees. Not ideal, but it saved me potentially thousands on monthly inventory fees.

FBA Sell-Through Rate

Sell-through rate measures how quickly you’re moving inventory through Amazon’s fulfillment centers. It’s calculated by dividing units sold over the past 90 days by the average number of units stored during that same time.

A low sell-through rate signals excess or stagnant inventory, which hurts your IPI score. I recommend trying to keep most of your listings above a 3.0. If something drops below 1.0, it usually means you ordered too much inventory or didn’t react fast enough to slower sales.

The solution to a poor Sell-Through Rate is very similar to how you deal with Excess Inventory. Start with pricing. Discounts, coupons, or a limited-time deal can increase sales and improve your sell-through rate. If that’s not enough, you can always increase your ad spend or bundle the product with a faster-moving item.

Stranded Inventory Percentage

Stranded inventory refers to products that are sitting in a fulfillment center but aren’t connected to an active listing. They’re sellable, but not for sale. And more importantly, they’re still racking up storage fees.

The most common causes for stranded inventory is suspended listings, price errors, system bugs, or closing a listing too early. You’ll want to check your Stranded Inventory Report weekly. It lives under Inventory > Manage Inventory > Fix Stranded Inventory in Seller Central. Amazon will usually give you a reason and a suggested fix.

If you do find that you have stranded inventory, in many cases, you can just relist the item or correct the pricing.

What Are Amazon FBA Capacity Limits?

Once you understand how your IPI score works, the next step is knowing how it directly affects how much inventory Amazon will let you send.

Amazon sets FBA capacity limits based on your recent performance. These limits control how much inventory you’re allowed to store each month, and they’re measured in cubic feet. In 2025, Amazon reduced those limits from six months of expected sales volume to five, which has made it harder for sellers to plan ahead, especially during sale periods or the holiday season.

Your IPI score plays a big role in how much space you get, but it’s not the only factor. Amazon also looks at your sales history, shipment timing, catalog efficiency, and what types of products you sell. If your account is performing well, you’ll generally have more room to work with.

How to Check Your FBA Capacity Limits

You can view your current FBA limits in the Capacity Monitor, which is found at the bottom of your FBA Dashboard in Seller Central. It shows your usage by storage type, how much space you have left, and a projection of your limits over the next three months. I recommend checking this often, especially when prepping for a new product launch or preparing for the holiday season.

How Are Capacity Limits Determined?

Amazon sets your FBA capacity based on how efficiently you manage your inventory. Your IPI score carries the most weight, but it’s not the only factor. They also look at your recent sales, forecasted demand, and how consistently you send in shipments. The goal is to prioritize sellers who make consistent sales and avoid clogging up warehouse space with stale inventory.

If you’re a new seller with a Professional Seller Account, you won’t be subject to FBA capacity limits for your first 39 weeks in business. This gives Amazon time to track your sales history and evaluate how you manage inventory. After that initial window, your limits are based on your IPI score and performance. Individual sellers, on the other hand, are capped at 15 cubic feet total, with no grace period.

How to Request More Inventory Space

If you’re running out of inventory space, Amazon gives you a way to request more storage through the Capacity Manager in Seller Central. You’ll find it under your FBA Dashboard, usually toward the bottom. From there, you can see how much space you’re using and how much you’re projected to get over the next few months.

To request more space, you’ll need to place a reservation bid. You choose how much capacity you want and how much you’re willing to pay per cubic foot. Amazon ranks bids based on your offer and your performance metrics, like your IPI score. If your request is approved, you’re charged an upfront reservation fee. But if you generate strong sales with that extra space, Amazon gives you a performance credit of $0.15 for every dollar in revenue. This means that if you sell enough, the fee can be almost fully offset. In some cases, the extra space ends up costing nothing.

If you’re going to need extra space, whether for Prime Day, a product launch, or Q4, it’s important to get your request in early. Amazon usually updates the next month’s capacity limits around the third Monday of the current month, and the request window closes fast. Set a reminder and move quickly when it opens.

Just remember: approvals aren’t guaranteed. Amazon looks at your sales velocity, IPI score, and how consistently you send in FBA shipments. The better your numbers, the better your chances.

Amazon Inventory Fees You Need to Watch

If you’re not careful, inventory fees can eat through your margins faster than you think. Most new sellers worry about product costs and ad spend, but the real damage often comes from fees they didn’t even know existed.

Amazon charges more than just fulfillment and referral fees. Once your inventory hits their warehouses, you’re on the hook for storage, aging stock, low supply levels, and how efficiently you use space.

If you want a full breakdown of everything Amazon charges, check out my complete guide to Amazon seller fees. But if you’re focused on inventory management, the ones below are the most important to understand.

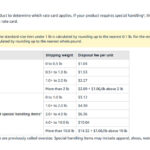

| Fee Name | When It Triggers | 2025 Rates | Why It Matters |

|---|---|---|---|

| FBA Storage Fee | Based on space used, charged monthly | $0.78/cu ft (Jan–Sep), $2.40/cu ft (Oct–Dec) | Q4 rates triple. Holding excess inventory gets expensive fast. |

| Aged Inventory Surcharge | Inventory aged 180+ days | $0.50-$6.90+/cu ft based on inventory age | Charged monthly. Rate continually increases. Gets expensive fast. |

| Storage Utilization Surcharge | Stock exceeds 22 weeks of supply (excl. <30-day inventory) | $0.46–$0.94/cu ft based on overage tier and size | Penalizes overstocking. The more excess inventory you carry, the more it costs you. |

| Low-Inventory Level Fee | <28 days of stock based on 30- and 90-day history | $0.32-$1.11/unit based on size/weight and days of supply | Punishes understocking. Adds fees to shipped units if you run too lean. |

| Removal/Disposal Fees | When you remove or destroy unsold FBA inventory | $0.97-$14.32/unit based on size/weight | Cheaper than paying long-term storage fees each month. |

| Returns Processing Fee | High return rate in non-exempt categories | $1.65-$157.35 based on item size/weight | Extra cost on top of refunded FBA fees. Keep return rates low to avoid charges. |

| Inbound Placement Fee | Using “minimal shipment splits” instead of Amazon’s routing | $0.12-$0.68/unit based on size/weight and shipment splits | Pay extra for convenience. You can skip this by routing to multiple FCs yourself. |

| Unplanned Service Fee | Prep or labeling errors on inbound inventory | $0.20–$2.00/unit depending on the task | Fully avoidable. Follow Amazon’s prep rules or use a reliable 3PL. |

6 Common Inventory Mistakes (and How to Fix Them)

Most inventory problems don’t start big. They usually come from ordering too much, not ordering soon enough, or assuming sales will stay steady when they don’t. Small missteps like that can snowball fast once fees kick in or stock runs out.

I’ve made a few of these mistakes myself. And over the years, I’ve seen them trip up plenty of new sellers, especially when things start moving fast and they don’t have a system in place yet.

Let’s go through the six issues I see the most, and more importantly, how to fix them before they cost you.

Overstocking

Overstocking is one of the most common mistakes new sellers make. You send in a big shipment, thinking you’ll “play it safe”, and suddenly you’re sitting on six months of unsold inventory. That might not sound terrible. until Q4 hits and your storage fees triple, your IPI score tanks, and you’re forced to put in a removal order just to make room.

Amazon doesn’t like stagnant inventory. If it’s sitting for more than 90 days, you’ll get dinged with excess inventory metrics. Sit on it longer than 180 days, and aged inventory fees start stacking up. Beyond the money, it also ties up capital that could be used in other parts of your business.

The most important advice I can give you is, don’t wait to act. Discount stale inventory before it triggers long-term fees. Use ads to increase sales velocity. And as a last resort, pull it or liquidate it before you lose too much money in additional fees.

Understocking & Stockouts

Running out of stock hurts more than just your sales. It wrecks your organic ranking, your Buy Box share, and your sales momentum. Even a 48-hour stockout can push you from page one to page five. And climbing back up takes way more effort than staying there in the first place.

To avoid this, track your sales velocity and calculate your reorder point based on your lead time. It’s also a good idea to always factor in some buffer stock for delays. And if inventory’s running low, consider raising your price slightly or pausing ads to buy myself a few more days. It’s not ideal, but it’s better than selling out completely.

Ignoring Seasonality

Sales on Amazon follow clear seasonal patterns. Back-to-school, Prime Day, Black Friday—they’re predictable, but only if you’re paying attention. Ignoring them leads to over-ordering during quiet months or stock-outs when demand spikes.

If you’re a new seller, it’s easy to get caught off guard. You might reorder based on your current sales without realizing those numbers will double in a month. Start by looking at your own sales data from the previous year to predict upcoming sales volume. If you don’t have a lot of sales history yet, use tools like Keepa to check the historical sales of similar products. Use this information to get a better idea of how much inventory you’ll need in the coming weeks and months.

When it comes to Q4, don’t send all your inventory in at once. Ship in waves so you can adjust as sales pick up. If your first shipment sells faster than expected, you’ll still have time to restock. If it moves slower, you’ve saved yourself from paying peak storage fees on unsold inventory. This way, you have more room to react without locking up capital or maxing out your FBA storage limit too early.

Not Planning for Lead Time

A lot of sellers underestimate how long it really takes to restock. It’s not just production. You’ve got to factor in freight, customs, Amazon check-in delays, and potential prep center issues.

If you’re off by a week or two, it might not seem like a big deal. But if it causes a stockout, you’ll feel it in lost sales and lost organic ranking.

Track every stage of your replenishment process. Know your average lead time for each product. I usually build in at least two extra weeks during Q4, just to stay safe. And if you’re cutting it close, don’t guess. Instead, get on the phone with your supplier. It’s better to ship early than scramble later.

Stranded Inventory

This one stings because it’s so avoidable. Stranded inventory means your product is in a fulfillment center, but customers can’t buy it. So you end up paying storage fees, but earning nothing in return.

It happens for all kinds of reasons: pricing errors, incomplete listings, a missing image, or a random system bug. And Amazon won’t always alert you. I’ve had SKUs stranded for several days before I caught them.

Get in the habit of checking your “Fix Stranded Inventory” page in Seller Central. Relist products when you can. Remove old or expired items if you need to. And don’t delete a listing the minute you go out of stock. That’s how you lose track of returned or misplaced units. A few minutes a week here can save you thousands in missed sales and storage costs.

No Backup Fulfillment Option (FBM, 3PL)

One thing I always recommend to new sellers is to keep backup inventory with a 3PL or even in your garage. It gives you the ability to drip-feed shipments to Amazon when space opens up. It also helps during Q4, when Amazon’s check-in times can increase. I also recommend using FBM during peak sales periods so you can keep selling while waiting on restocks.

Backup fulfillment doesn’t have to be complicated. A good 3PL can handle storage, prep, and even Multi-Channel Fulfillment if you sell on other platforms. Or you can just keep a few boxes of bestsellers on hand to ship yourself in a pinch. The point is: don’t let FBA be your single point of failure.

How to Forecast and Restock Inventory

Inventory mistakes are often a sign of poor forecasting, not a bad product or a lack of effort. If you don’t have a clear system to track sales, lead time, and stock levels, you’re guessing. And on Amazon, guessing is expensive.

Here’s how I recommend forecasting and restocking inventory for your FBA business.

Simple Way to Calculate 60-Day Supply

If you want to avoid stockouts without getting buried in storage fees, aim to keep about 60 days of inventory on hand for your top SKUs. That’s usually enough to cover delays, avoid low-inventory-level fees, and keep your sales steady.

To calculate how much to reorder, you can use the reorder point formula:

Here’s an example using real numbers:

- You sell 20 units per day

- Your lead time (from order to Amazon check-in) is 30 days

- You keep 14 days of safety stock (20 × 14 = 280 units)

So: (20 × 30) + 280 = 880 units. That means when inventory drops below 880 units, you should reorder. It gives you just enough buffer to receive the new shipment before running out.

If you’re just trying to hold a 60-day supply on hand, it’s even easier:

Average Daily Sales × 60

In this example, that’s 20 × 60 = 1,200 units. That’s your target stock level.

Tracking lead time is key. Try to log every step, from the supplier invoice to Amazon receiving. If your shipments keep getting delayed during Q4, adjust your lead time upward. Don’t assume it’ll be the same year-round.

Should You Use a Paid Inventory Management Tool?

If you’re a newer seller with just a few SKUs, you probably don’t need paid inventory software right away. A well-built spreadsheet can handle the basics like tracking stock levels, sales velocity, and expected lead times. That’s how I managed my own inventory early on. But as my business grew and I started juggling multiple suppliers, product variations, and restock cycles, the manual approach became harder to keep up with.

Inventory software solves a lot of the problems that creep in once your business gets more complex. It tracks your stock levels automatically, calculates when to reorder based on your actual sales, and flags potential stockouts before they happen. Many tools also forecast demand using historical sales data and can adjust for seasonality or upcoming promos. Some even sync with your 3PL to help manage inventory across warehouses or prep centers. If you’re someone with a larger product catalog and multiple suppliers, having those systems in place makes a big difference.

If you’re looking for trusted options, I’ve reviewed several of the top Amazon inventory management tools that can help you save time and stay organized while you manage your business.

Frequently Asked Questions (FAQ’s)

How much does it cost to keep inventory at Amazon?

Amazon’s storage fees depend on the size of your product and the time of year. For standard-size items, you’ll pay $0.78 per cubic foot per month from January through September. During Q4 (October through December), that jumps to $2.40 per cubic foot. Oversized products are cheaper by volume, at $0.53 off-peak and $1.40 during the peak season, but they obviously take up more space.

How do I check my inventory limit on Amazon?

To check your inventory limit on Amazon, log in to Seller Central, go to Inventory > Inventory Performance, and look for Capacity Monitor at the bottom of the page. Here you’ll see how much space you’re using and your projected limits for the next three months.

These limits depend on your IPI score, recent sales, and how efficiently you’ve managed your inventory. If you’re a new professional seller (under 39 weeks), you’ll usually start without limits so you can build sales history.

What’s the best way to avoid long-term storage fees?

To avoid long-term storage fees, focus on keeping your products moving. If you’re struggling to make sales, try a discount, bundle, or consider launching an ad campaign.

And if none of that works? Create a removal order and sell through another channel. With Amazon lowering removal costs, it’s a better option than paying long-term storage fees each month.

How does Amazon define excess inventory?

Amazon flags inventory as “excess” if you have more than 90 days of supply or even a single unit that’s been sitting for over 90 days.

This usually means you’ve over-ordered or your sales have slowed. Excess inventory ties up capital, racks up storage fees, and lowers your IPI score.

How do I liquidate my Amazon inventory?

To liquidate Amazon inventory, go to the FBA inventory page in Seller Central. Select your product, click the actions menu, and choose “Create removal order.” Select “Liquidations” as the removal method. Amazon pays 5-10% of the average selling price, minus a 15% referral fee and processing costs.

Conclusion: What Smart Inventory Management Looks Like

Smart inventory management is all about staying proactive, responsive, and informed.

It starts with knowing your numbers. Keep an eye on your IPI score, watch for aging inventory, and track sales velocity across your top SKUs. If something’s not moving, it’s important to be proactive. If you’re running low, raise your prices or pause ads to buy time while your next shipment lands.

Use Amazon’s inventory tools as a starting point, then build your own system around them. Whether that’s a well-organized spreadsheet or third-party inventory software depends on how complex your business is. For some sellers, basic tracking works fine. Others might need demand forecasting, safety stock alerts, and more automation. Whatever you choose, the goal is to stay in control of your inventory without letting it run your business.

Recommended Articles

- How to Start an Amazon FBA Business in 7 Simple Steps

- How Much Are Amazon Seller Fees in 2026? [Complete Cost Breakdown]

- Amazon Order Defect Rate: What It Is and How to Improve It

Levi Adler is an experienced Amazon seller, e-commerce specialist, and the founder of Levi’s Toolbox. With over a decade in the trenches selling on Amazon and managing his own Shopify stores, Levi writes from his own experience. Sharing what worked, what flopped, and the strategies he wishes he’d known sooner. When he’s optimizing listings or managing ad campaigns, you’ll find Levi hitting mountain bike trails or hanging out with his two huskies, Emma and Scout.